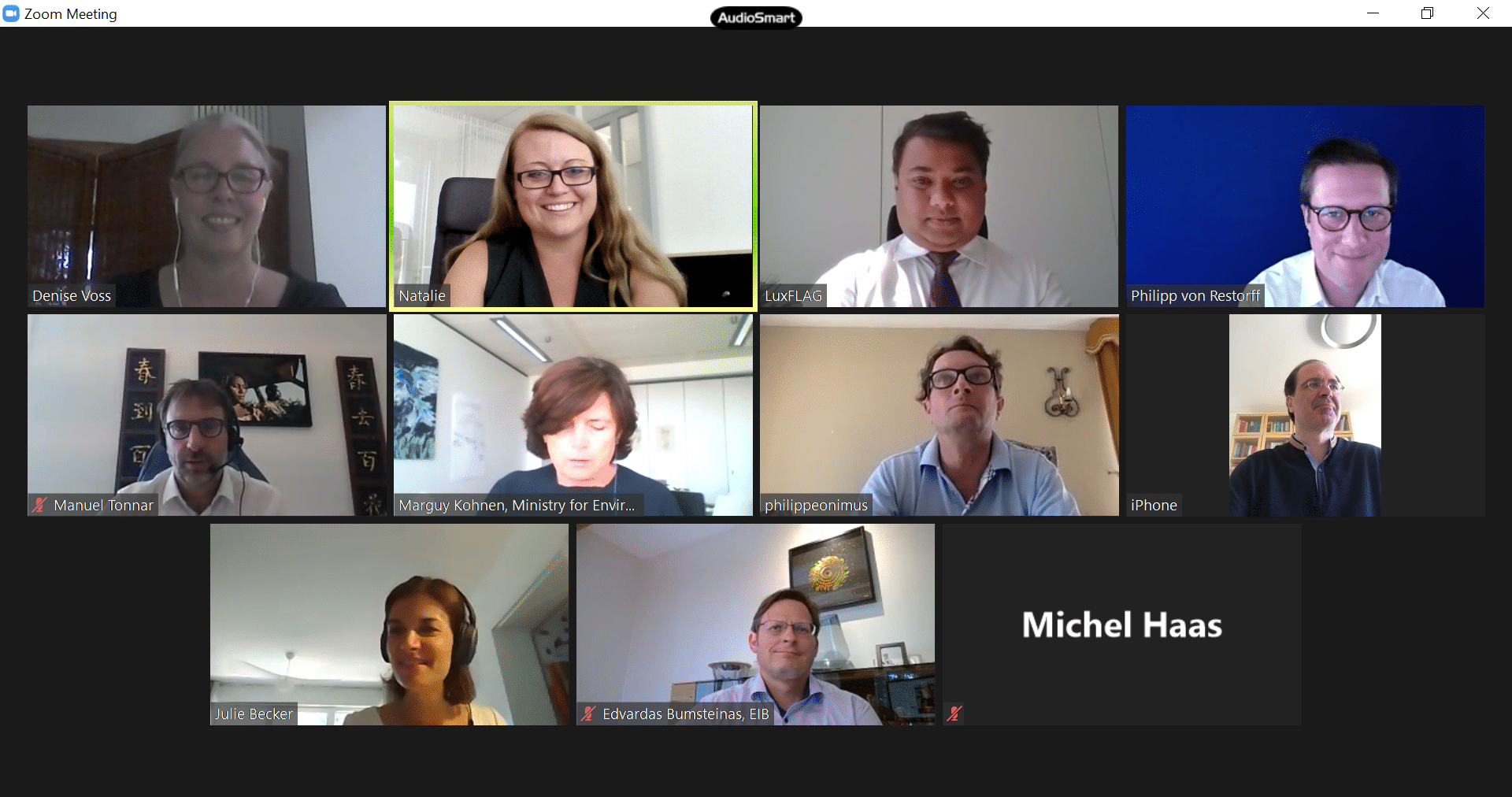

LuxFLAG’s Annual General Meeting of Charter Members took place on 24 June 2020.

Representatives of the LuxFLAG Charter members viz. Luxembourg Bankers’ Association (ABBL), Appui au Développement Autonome (ADA), Association of the Luxembourg Fund Industry (ALFI), European Investment Bank (EIB), Luxembourg Stock Exchange, Luxembourg for Finance (LFF), Luxembourg Ministry of Finance, Luxembourg Ministry of Environment, Climate and Sustainable Development and Luxembourg Ministry of Foreign and European Affairs took part in the discussion.

LuxFLAG activity report 2019-2020.

The message of the Chairwoman and General Manager

Dear Members, Friends and Colleagues,

Sustainable finance has become a priority of 2019 for investors, asset managers and for the financial services industry as a whole. LuxFLAG plays an important role in advancing the sustainable finance agenda in Luxembourg and at the European level, which is evident judging by the 2019 results.

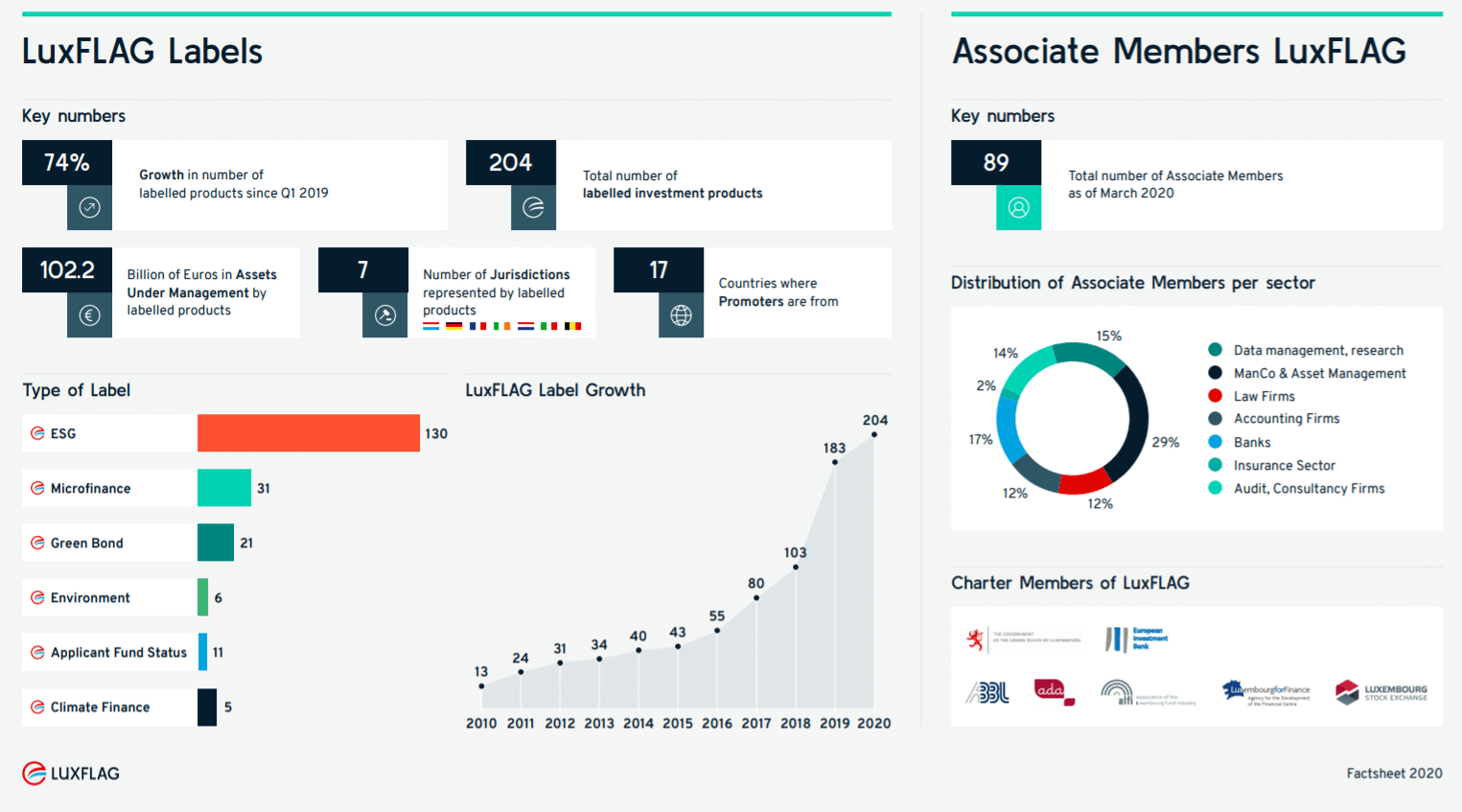

At the end of 2019, LuxFLAG had issued labels to 183 investment vehicles worth over EUR 75.5 billion. The non-profit association reported an increase in its number of labels by close to 78% in 2019. The labelled products’ assets under management increased by more than 58%. The investment vehicles labelled by LuxFLAG reached over 700 Microfinance institutions in 94 countries. The labelled ESG funds used multiple sustainability strategies to account for environmental, social and governance topics in their investment decision making. Furthermore, the labelled climate finance funds engaged in climate change mitigation and adaptation activities across a broad range of sectors.

Through the agency’s second pillar of activity, which is the LuxFLAG Associate Membership Program, LuxFLAG aims to raise awareness and share expertise on Sustainable Finance with the financial services actors. Towards this end, at December 2019, the agency had increased its active Associate Members to 94, an increase of almost 25% in one year. Events organized in partnership with our Associate Members, such as the LuxFLAG Sustainable Investment Week (LSIW) 2019, received tremendous response in terms of attendees in its first year and managed to establish itself as a key event within the area of sustainable finance. Moreover, LuxFLAG promoted sustainable finance through speeches and panel moderations at over 45 international and national conferences, as well as through interviews and articles in the international and national press.

With the ever-changing regulatory framework on sustainable finance at the EU level, LuxFLAG actively built its resources and expertise around the topic, in order to update its eligibility criteria and labelling framework, to be applied whenever and wherever necessary. LuxFLAG actively participated in the discussions on the EU Action Plan for financing sustainable growth and remains closely involved in the development of the EU Eco Label for financial products.

We would like to express our gratitude to our Honorary President Her Royal Highness the Grand Duchess, the Luxembourg Government, ALFI, ABBL, ADA, the European Investment Bank, Luxembourg for Finance, the Luxembourg Stock Exchange, LuxFLAG’s Board of Directors, our labelled investment vehicles, our Associate members, members of the Eligibility Committees and the LuxFLAG team for their most valuable support and confidence.

*** End ***