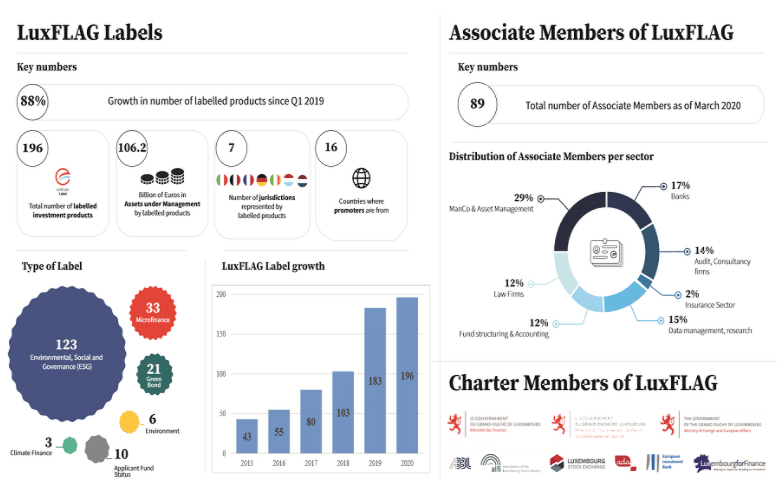

LuxFLAG is pleased to announce that 27 new funds (24 ESG, 1 Climate Finance, 1 Microfinance, 1 Applicant Fund status) have been granted a LuxFLAG label bringing the total to 196 investment products with Eur 106 billion AuM as at the 26th of March.

These products are domiciled in seven jurisdictions viz. Belgium, France, Germany, Ireland, Italy, the Netherlands and Luxembourg and are managed in 16 countries.

The number of LuxFLAG labelled investment products grew by 88% over the last 12 months reflecting the growing importance of highlighting the ESG credentials of fund products and a strong growth in sustainable investing.

The newly labelled ESG Funds are:

- Aviva Investors Climate Transition European Equity

- Comgest Growth Emerging Markets

- Comgest Growth Emerging Markets Plus

- Comgest Growth Europe

- Comgest Growth Europe Plus

- Comgest Growth World

- Comgest Magellan

- Comgest Monde

- Comgest Renaissance Europe

- CPR Invest – Global Equity ESG

- CPR Japan ESG

- Credit Suisse (Lux) Edutainment Equity Fund

- Eiffel Impact Debt

- FDC SICAV EUR Green Bonds – Actif 1

- Fidelity Funds – Sustainable Eurozone Equity Fund

- Fidelity Funds – Sustainable Reduced Carbon Bond Fund

- Fidelity Funds – Sustainable Strategic Bond Fund

- Franklin Liberty Euro Short Maturity UCITS ETF

- Janus Henderson Horizon Global Sustainable Equity Fund

- Moorea Fund – Euro Fixed Income

- Moorea Fund – European Equity Quality Income

- Nordea 1 – Emerging Stars Bond Fund

- Nordea 1 – European Corporate Stars Bond Fund

- Nordea 1 – European High Yield Stars Bond Fund

The fund which was granted the LuxFLAG ESG Label Applicant Fund Status is:

- Empira ESG Office Top 7 SCS SICAV-RAIF

The newly-labelled Microfinance Fund is:

- R-Co 4Change Impact Finance

The newly-labelled Climate Finance Fund is:

- BlackRock Global Renewable Power III

LuxFLAG Labels are valid for a period of one year and are subject to renewal on expiry.

Kindly contact us for further information.

Factsheet_LuxFLAG_26032020