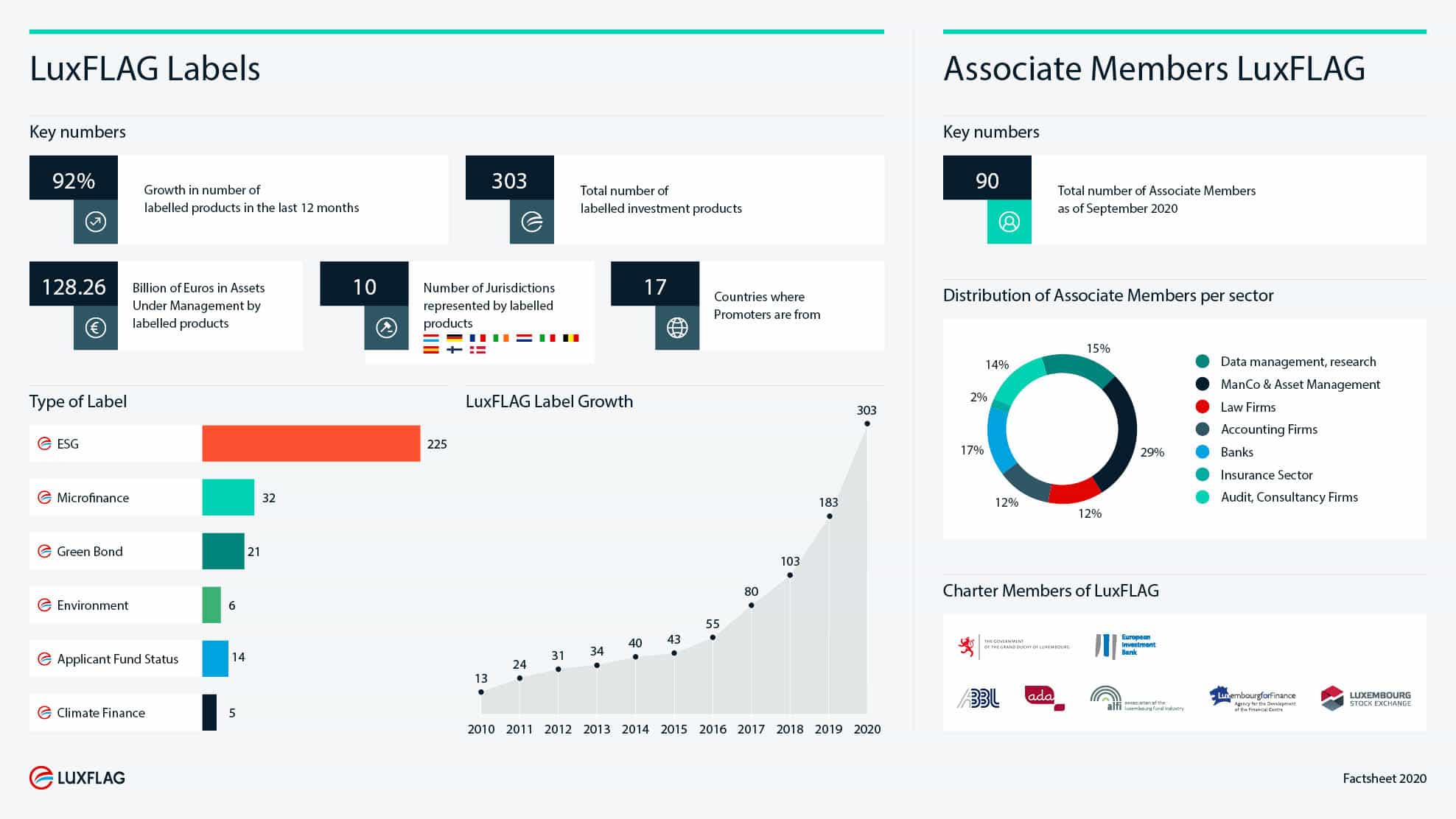

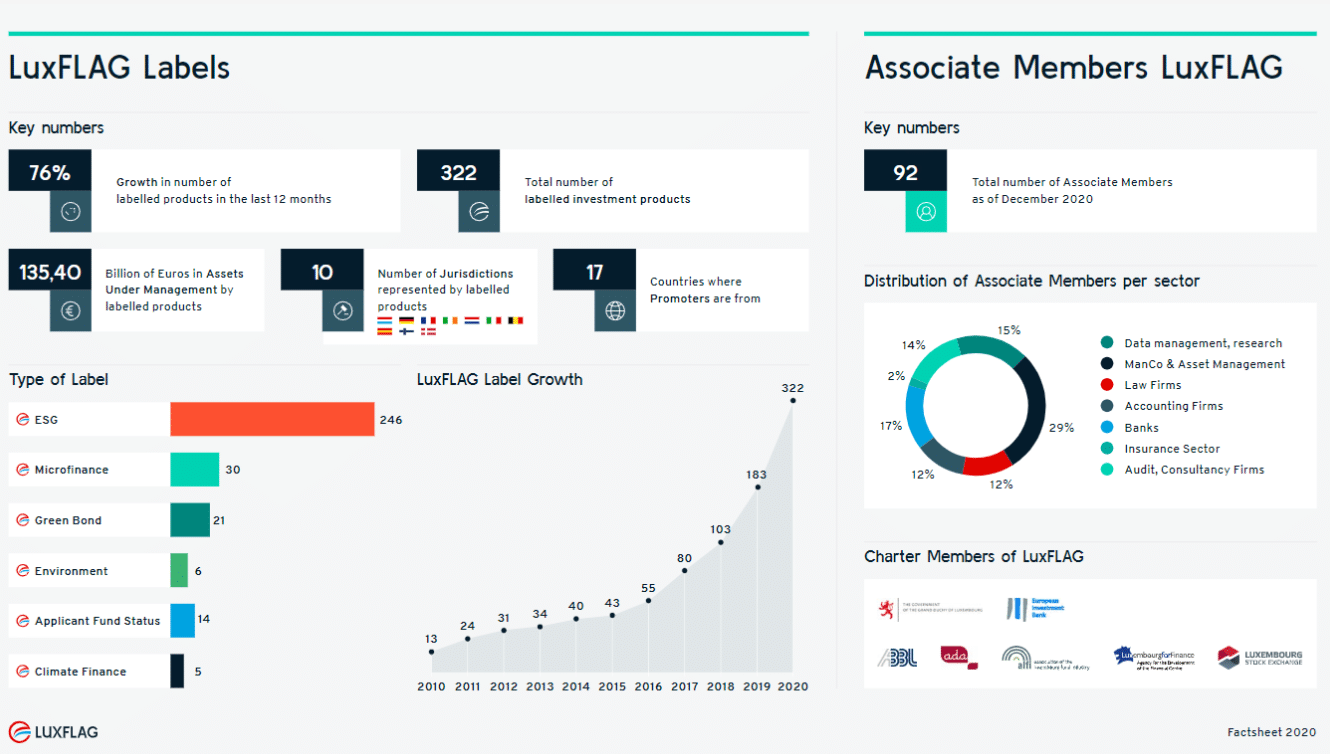

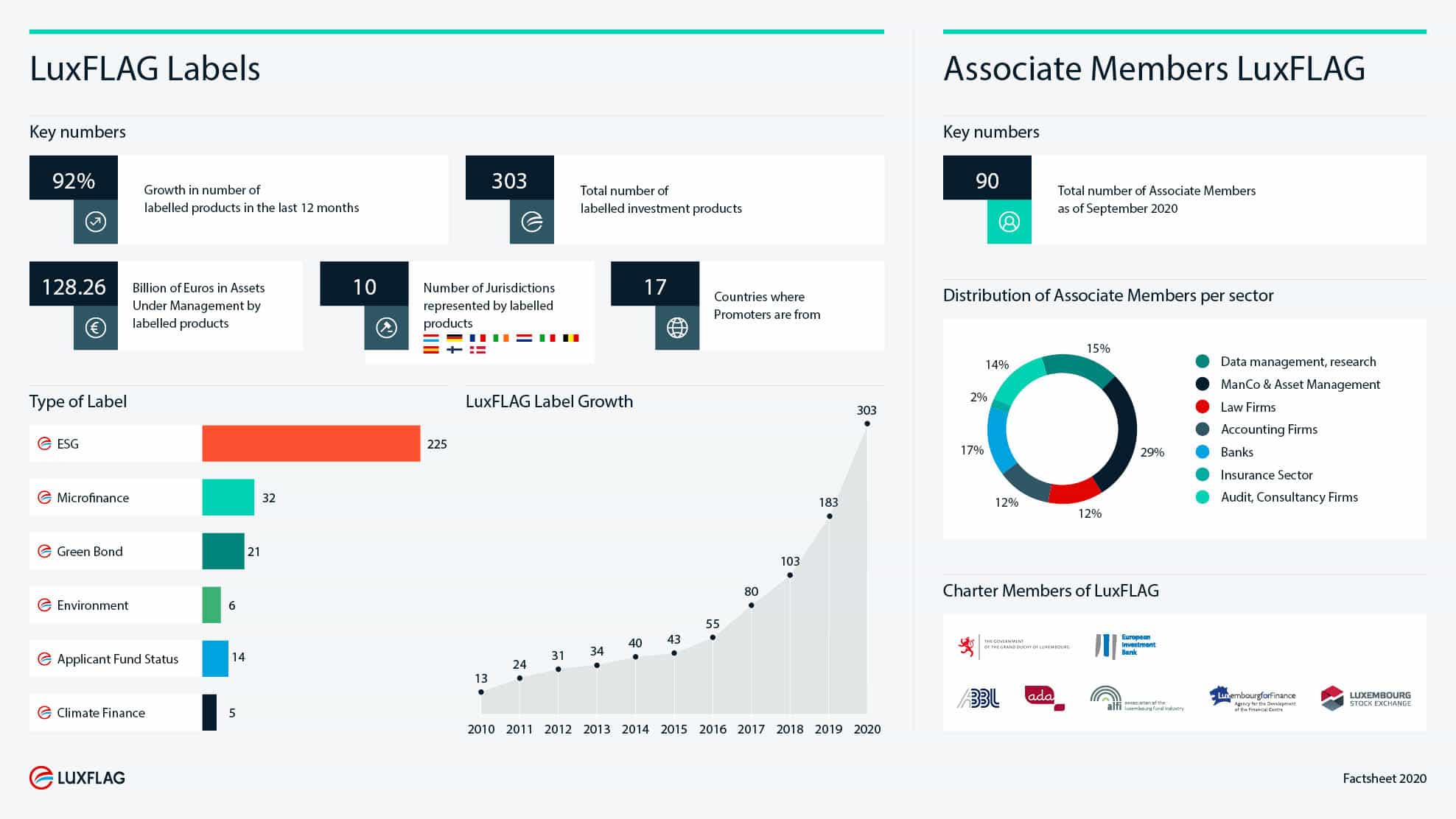

LuxFLAG is pleased to announce that 100 funds (95 ESG, 1 Microfinance, 1 Environment Applicant Fund Status and 3 ESG Applicant Fund Status) have been granted the use of the LuxFLAG label, bringing the new total to 303 investment products with Eur 128,26 billion AuM as at 22nd September 2020.

These products are domiciled in ten jurisdictions, viz. Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Luxembourg and Spain. The funds are managed in 17 countries by 98 asset managers.

The number of LuxFLAG labelled investment products has grown by 92% since Q3 2019, reflecting the strong growth in sustainable investing.

The newly labelled ESG Funds are:

- Agri-Business Capital Fund (ABC) S.A SICAV-RAIF

- Alken Fund Continental Europe

- Alken Fund Global Convertibles

- Alken Fund Income Opportunities

- Bluebay Global High Yield ESG Bond Fund

- Comgest Groth America

- Danske Invest – Danmark – Akkumulerende KL

- Danske Invest – Danmark Fokus KL

- Danske Invest – Danmark KL

- Danske Invest – Euro High Yield-Obligationer – Akkumulerende KL

- Danske Invest – Euro High Yield-Obligationer KL

- Danske Invest – Euro Investment Grade-Obligationer KL

- Danske Invest – Europa – Akkumulerende KL

- Danske Invest – Europa 2 KL

- Danske Invest – Europa Højt Udbytte – Akkumulerende KL

- Danske Invest – Europa Højt Udbytte KL

- Danske Invest – Europa KL

- Danske Invest – Europa Small Cap – Akkumulerende KL

- Danske Invest – Europa Small Cap KL

- Danske Invest – Global Plus KL

- Danske Invest – Global StockPicking – Akkumulerende KL

- Danske Invest – Global StockPicking KL

- Danske Invest – Globale Virksomhedsobligationer KL

- Danske Invest – Horisont 100 – Akkumulerende KL

- Danske Invest – Horisont 20 – Akkumulerende KL

- Danske Invest – Horisont 35 – Akkumulerende KL

- Danske Invest – Horisont 50 – Akkumulerende KL

- Danske Invest – Horisont 65 – Akkumulerende KL

- Danske Invest – Horisont 80 – Akkumulerende KL

- Danske Invest – Horisont Rente Konservativ – Akkumulerende KL

- Danske Invest – Horisont Rente Pluss – Akkumulerende KL

- Danske Invest – Nordiske Virksomhedsobligationer – Akkumulerende KL

- Danske Invest – Norske Korte Obligationer – Akkumulerende KL

- Danske Invest – Nye Markeder Obligationer – Akkumulerende KL

- Danske Invest – Nye Markeder Obligationer KL

- Danske Invest – Østeuropa KL

- Danske Invest Allocation – Horisont Aktie

- Danske Invest Allocation – Horisont Balanserad

- Danske Invest Allocation – Horisont Försiktig

- Danske Invest Allocation – Horisont Offensiv

- Danske Invest Allocation – Horisont Ränta

- Danske Invest – Compass 25 Fund

- Danske Invest – Compass 50 Fund

- Danske Invest – Compass 75 Fund

- Danske Invest – Compass Equity Fund

- Danske Invest – Compass Liquidity Fund

- Danske Invest – Eastern Europe Convergence Fund

- Danske Invest – Emerging Markets Debt Fund (AIF)

- Danske Invest – Euro Corporate Bond Fund

- Danske Invest – Euro High Yield Fund

- Danske Invest – Europe High Dividend Fund

- Danske Invest – Europe Small Cap Fund

- Danske Invest – European Equity Fund

- Danske Invest – Finnish Equity Fund

- Danske Invest – Institutional Liquidity Fund

- Danske Invest – Institutional Liquidity Plus Fund

- Danske Invest – Liquidity Fund

- Danske Invest – Russia Fund

- Danske Invest Index – Europe Restricted – Accumulating KL

- Danske Invest Index – Global AC Restricted – Accumulating KL

- Danske Invest Index – Global Emerging Markets Restricted – Accumulating KL

- Danske Invest Index – Japan Restricted – Accumulating KL

- Danske Invest Index – Norway Restricted – Accumulating KL

- Danske Invest Index – Pacific incl. Canada ex. Japan Restricted – Accumulating KL

- Danske Invest Index – Sweden Restricted – Accumulating KL

- Danske Invest Index – USA Restricted – Accumulating KL

- Danske Invest Select – Euro Investment Grade Corp Bonds Restricted KL

- Danske Invest Select – Global Restricted KL

- Danske Invest Select – Global Stock Picking Restricted – Accumulating KL

- Danske Invest Select – Norske Aktier Restricted – Akkumulerende KL

- Danske Invest SICAV – Denmark Focus

- Danske Invest SICAV – Eastern Europe

- Danske Invest SICAV – Emerging Markets Debt Hard Currency

- Danske Invest SICAV – Euro Investment Grade Corporate Bond

- Danske Invest SICAV – Euro Sustainable High Yield Bond

- Danske Invest SICAV – Europe

- Danske Invest SICAV – Europe High Dividend

- Danske Invest SICAV – Europe Small Cap

- Danske Invest SICAV – European Corporate Sustainable Bond

- Danske Invest SICAV – Global Corporate Sustainable Bond

- Danske Invest SICAV – Nordic Corporate Bond

- Danske Invest SICAV – Russia

- Danske Invest SICAV – SRI Global

- Danske Invest SICAV – Sverige

- Danske Invest SICAV – Sverige Beta

- Danske Invest SICAV – Sverige Kort Ränta

- Danske Invest SICAV – Sverige Ränta

- Danske Invest SICAV – Sverige Småbolag

- Decalia Millennials

- Fon Fineco Renta Fija Internacional, Fondo de Inversión

- THEAM Quant Europe Climate Carbon Offset Plan

- Tikehau 2027

- Tikehau Global Credit

- Tikehau Special Opportunities II Master Fund

- TOBAM Anti-Benchmark Listed Private Markets

The newly labelled Microfinance Funds are:

- Symbiotics SICAV (Lux.) –SEB Microfinance Fund VII

The funds which were granted the use of the LuxFLAG ESG Label Applicant Fund Status are:

- Eiffel Credit Opportunities UCITS

- Eiffel Essentiel

- Holon Real Estate S.C.A. SICAV-RAIF

The funds which were granted the use of the LuxFLAG Environment Label Applicant Fund Status are:

- Credit Suisse (Lux) Environmental Impact Equity Fund

Kindly contact us for further information.

Download LuxFLAG in numbers