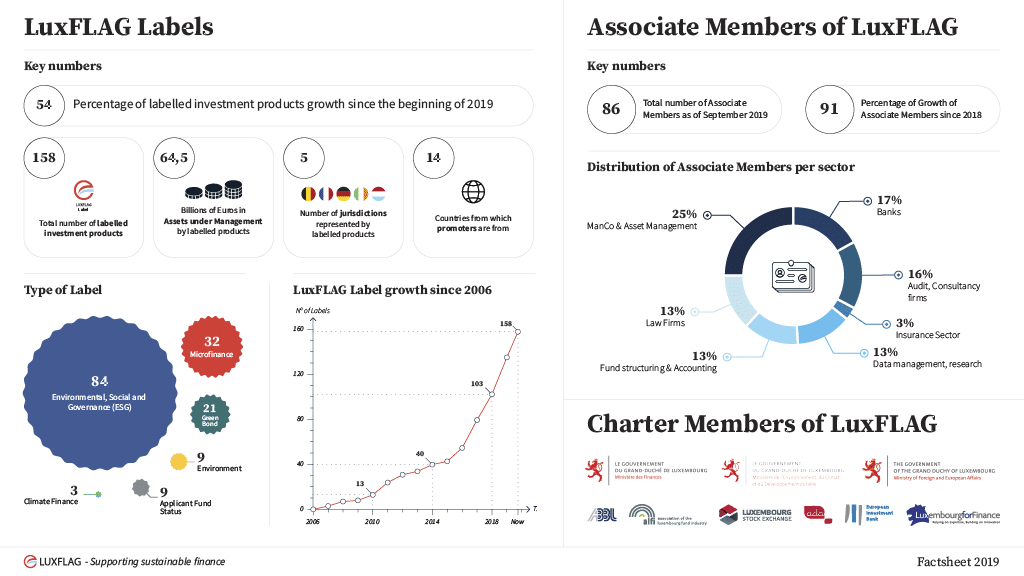

LuxFLAG, the Luxembourg Finance Labelling Agency, is pleased to announce that twenty-four new funds have been granted a LuxFLAG label bringing the total to 158 investment vehicles (84 ESG, 3 Climate Finance, 9 Environment, 32 Microfinance, 21 Green Bonds, 9 Applicant Fund status) as at the 24th September.

These products are domiciled in five jurisdictions viz. Belgium, France, Germany, Ireland and Luxembourg are managed in approx. 15 countries.

The number of LuxFLAG labelled investment vehicles grew by 53.4% since the beginning of the year reflecting the importance of highlighting the ESG credentials of fund products and strong growth in Sustainable investing.

The newly labelled ESG Funds are:

- Actiam (L) Sustainable Euro Fixed Income Fund

- Arcano Low Volatility European Income Fund

- Candriam SRI Bond Euro Corporate

- Candriam SRI Equity Europe

- FDC SICAV Actions Monde – Actif 1

- FDC SICAV Actions Monde – Actif 2

- Global Investors – Ethica Balance

- ING ARIA Sustainable Bonds

- Nordea 1 – North American Stars Equity Fund

- Tobam Anti-Benchmark All Countries World Equity Fund

- Tobam Anti-Benchmark Canada Equity Fund

- Tobam Anti-Benchmark Emerging Markets Equity Fund

- Tobam Anti-Benchmark Euro Equity Fund

- Tobam Anti-Benchmark France Equity Fund

- Tobam Anti-Benchmark Global High Yield Fund

- Tobam Anti-Benchmark Global Investment Grade Fund

- Tobam Anti-Benchmark Japan Equity Fund

- Tobam Anti-Benchmark Multi Asset Fund

- Tobam Anti-Benchmark Pacific Ex-Japan Markets Equity Fund

- Tobam Anti-Benchmark US Equity Fund

- Tobam Anti-Benchmark World Equity Fund

Funds which were granted the LuxFLAG ESG Label Applicant Fund Status are:

- Eiffel Impact Debt

- EU Balanced Fund

- Protea UCITS II – Eco Advisors ESG Absolute Return

The newly labelled Microfinance fund is:

- InsuResilience Investment Fund – Debt Sub-fund

LuxFLAG Labels are valid for a period of one year and is subject to renewal on expiry.

For further information, kindly contact us for further information.