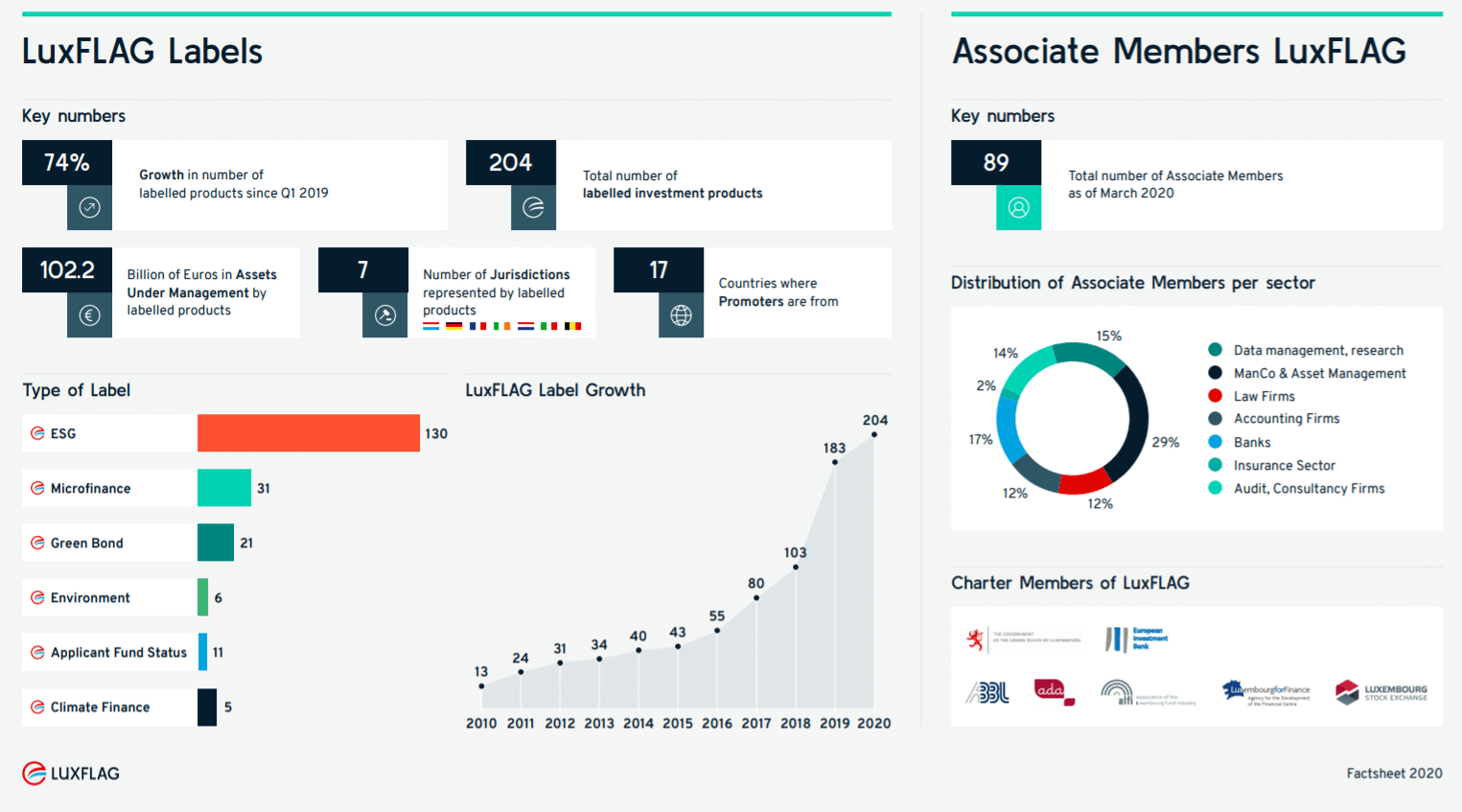

LuxFLAG is pleased to announce that 14 new funds (8 ESG, 2 Climate Finance, 1 Environment, 3 ESG Applicant Fund status) have been granted the use of the LuxFLAG label bringing the total to 204 investment products with Eur 102.2 billion AuM as at the 24th of June.

Moreover, the use of LuxFLAG Label to 31 funds was renewed for a period of one year.

These products are domiciled in seven jurisdictions viz. Belgium, France, Germany, Ireland, Italy, the Netherlands, and Luxembourg and are managed in 17 countries by 93 asset managers.

The number of LuxFLAG labelled investment products grew by 74% since Q1 2019 reflecting strong growth in sustainable investing.

The newly labelled ESG Funds are:

- AB SICAV I – Sustainable Global Thematic Portfolio

- Decalia Circular Economy

- DPAM L Bonds Climate Trends Sustainable

- MainFirst – Absolute Return Multi Asset

- MainFirst – Global Equities Fund

- MainFirst – Global Equities Unconstrained Fund

- Nordlux Pro FondsManagement – ESG Aktien Global

- Protea Fund – Orcadia Equities EMU SRI Ex-Fossil

The newly-labelled Climate Finance Funds are:

- InsuResilience Investment Fund – Debt Sub-Fund

- InsuResilience Investment Fund – Equity Sub-Fund

The newly-labelled Environment Fund is:

- The European Energy Efficiency Fund SA, SICAV-SIF

The funds which were granted the use of LuxFLAG ESG Label Applicant Fund Status are:

- Idinvest Smart City Venture Fund II

- Tikehau Direct Lending V

- Tikehau Impact Lending

LuxFLAG Labels are valid for a period of one year and are subject to renewal on expiry.

Kindly contact us for further information.